Trading/Brokerage Model

Please fill this form

The trading/brokerage concept has completely changed how people interact with the financial markets. The time when only affluent people or institutional investors could invest is long past. People from all walks of life can now participate in trading and investment activities because of the accessibility and convenience offered by trading platforms and brokerage services. We’ll go into the trading/brokerage model in this blog article, looking at its essential elements, advantages, and how it’s changed the face of financial markets.

The Trading/Brokerage Model: An Understanding

By conncting investors with financial markets, the trading/brokerage model refers to the framework that makes it easier to buy and sell financial items like stocks, bonds, commodities, and derivatives. In order to build a seamless and effective marketplace, a variety of organizations, including brokerage firms, trading platforms, exchanges, and regulatory authorities, are included.

Important Elements of the Trading and Brokerage Model

Brokerage Companies: Brokerage companies serve as a conduit between investors and the financial markets. They give their customers access to a platform or different financial instruments and carry out trades on their behalf. These businesses might also provide research, market analysis, and investment guidance.

Trading Platforms: The trading/brokerage model’s skeleton is now made up of online trading platforms. These systems let investors trade from the comfort of their homes, keep an eye on their investments, and get real-time market data. Anyone with access to the internet can now participate in trading activities thanks to trading platforms, which have democratized financial opportunities.

Exchanges: Exchanges act as markets where buyers and sellers of financial products can transact. They offer the framework for regulation and infrastructure required for orderly trading. The New York Stock Exchange (NYSE), Nasdaq, London Stock Exchange (LSE), and Tokyo Stock Exchange (TSE) are a few examples of well-known exchanges.

Regulatory Organizations: Organizations that regulate the trading/brokerage model include the Securities and Exchange Commission (SEC) in the United States and the Financial Conduct Authority (FCA) in the United Kingdom. To ensure honest and open trading practises, safeguard investors, and preserve market integrity, they enforce laws and regulations.

The Trading/Brokerage Model’s Advantages

Accessibility: A wider spectrum of people may now enter the financial markets thanks to the trading/brokerage paradigm. In the past, investment was frequently only open to people with substantial financial resources or specialized skills. Now, anyone can start investing with only a few clicks thanks to low account minimums and user-friendly platforms.

Cost-Effectiveness: When compared to traditional brokerage services, trading platforms and internet brokers offer much lower transaction costs. Investors can gain from lower commissions, smaller spreads, and occasionally even commission-free trading. It is simpler for investors to attain diversity and maximize their returns because of this cost-effectiveness.

Trading platforms give investors more ease and control over their investing choices. Without the use of middlemen or complicated paperwork, investors may conduct their own research, analyze their options, and place trades at their own pace and convenience. Investors are able to make knowledgeable judgements in real-time thanks to real-time market data and sophisticated trading tools.

Education and Research: To assist investors in advancing their knowledge and abilities, several trading platforms provide instructional materials, research resources, and market analysis tools. With the aid of these resources, people can better comprehend financial markets, create investment plans, and keep up with current market developments.

Individuals can now easily and conveniently participate in the financial markets thanks to the trading/brokerage paradigm, which has democratized investing opportunities. Investors now have more access, control, and cost-effectiveness over their trading activities thanks to brokerage houses, trading platforms, exchanges, and regulatory agencies.

The trading/brokerage paradigm has revolutionized how people interact with the financial markets, giving them unprecedented power to manage their money and engage in trading activities. Investors now have easier access, more economical and convenient ways to trade online, as well as educational materials to help them understand the complicated world of finance.

With the help of this model, obstacles have been removed, enabling people from all walks of life to invest in a variety of financial products, diversify their portfolios, and possibly increase their wealth. By providing retail investors with the same possibilities and resources as institutional investors, it has changed the power dynamics in the financial sector.

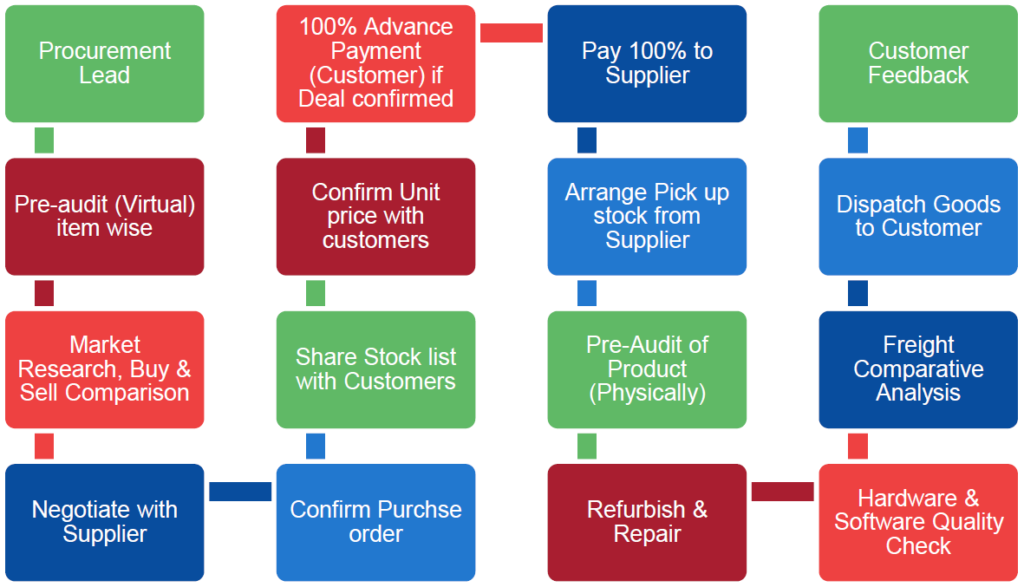

Al QAISER IT GROUP purchases used Laptops, Desktops, All in Ones, Tablets, Hard Drives and Apple products and phones. Stock lists are provided by suppliers that are individually identified, serial numbered, with specifications and conditions described, item by item. This allows the company to assess the profit achievable at a very granular level and market to customers whilst the goods are in transit.

Al QAISER IT GROUP completes deals via sea-freight that have up to an eight-week lead time and air freights product for a faster turnaround. The supplier is paid, and the goods are shipped. The goods can come back to the UAE or be distributed directly from the supplier to the customer. As the goods are nearing port, they are presented to potential customers, and generally sold even before they land. Once the goods arrive, they are moved to HQ, cleaned, re-packaged and forwarded to the customer.

Before the goods are shipped, customers pay for the goods. For export sales, the company requires a 20% payment to ship the goods and retains the bill of lading, which serves as a proof of ownership (title) of the cargo until arrival and the balance is paid and goods are then released to the customer.

Deal size and flow depends on seasonal fluctuations, overseas holidays, and market movement. The largest trades are purchased from Australia and US/Canada, and sold in Africa, Egypt, Pakistan, China, Dubai, and mainland Europe for best margins according to the type of product. The company has a truly global capability.